Filing Tax Returns for 2019 - IRS Postponement Deadline COVID-19

FILING EXTENSIONS FOR 2019 TAX YEAR

Today marks the deadline for filing your tax return: April 15th. But, if you haven’t filed or didn’t request for an extension, don’t fret! The IRS And the California’s Franchise Tax Board announced that for any affected taxpayer, the due date for filing Federal & State income tax returns and making Federal & State income tax payments due April 15, 2020, is automatically postponed to July 15, 2020 - see the official notice for federal here and for California state here (for other states, view this list here).

I decided to share this because I received my stimulus check today via direct deposit from the IRS, and they calculated the amount that was sent to Scott and I based off of our most recently filed tax return. If you’re still needing to file, I highly suggest using Credit Karma!

FILING ON MY OWN

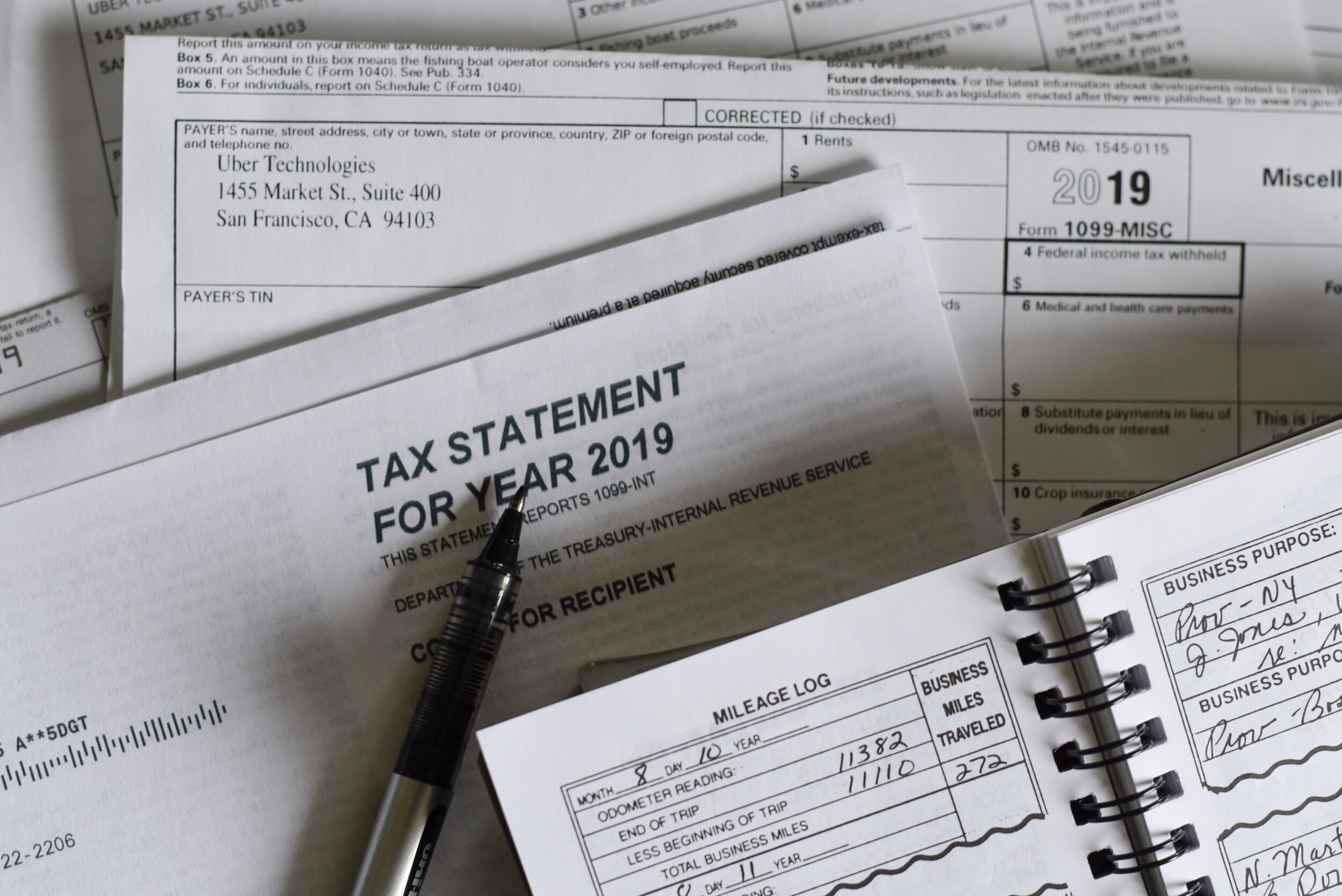

I started having to file on my own about 7 years ago when my dad told me that I owed just about $2000 to the IRS - I was in shock as every year before that my dad had taken care of everything, so I had no clue what to do and didn’t have the money. So I had to get connected with his tax lady - and she helped me figure out how to file for my employed work as well as my own business as a sole proprietor. That’s when the world of business write offs were introduced to me. I worked with this tax preparer for a couple years or so, then started using Turbo Tax 2013-2016, but stopped using it since the cost kept increasing to file with my small business expenses. I was so happy to stumble upon the tax services through Credit Karma since I use the platform to check my credit score and financial health.

WHY CREDIT KARMA

I keep using year after year and can’t rave enough about Credit Karma for tax prep and filing because the website is easy to navigate, simple to use and it’s absolutely FREE - no matter how many deductions you may have, or how complex your return may be. I feel like other programs will claim to be free, but if you’re a blogger, creative or independent contractor filing like I have, you’ll go through the entire process and at the end you have to pay a hefty fee to actually submit your return (this happened to be a couple times).

IMPROVEMENTS FOR CREDIT KARMA

Where Credit Karma lacks in the prep process are more helpful descriptions for each field within the filing, it didn’t affect my ability to input my information correctly, but when using TurboTax, I felt like I received more informative descriptions on what each field on each tax form/section. Credit Karma has a great support team, but when I reached out this time around, I I didn’t get a response until 8 days later due to the influx of customer inquiries they were experiencing. I think due to the nature of my inquiry, I should have received a response within 48 hours, but thankfully I was able to figure everything out on my own.

INCLUDED PERKS

Credit Karma also guarantees a Max Refund, Accurate Calculations (which we received exactly the amounts that were calculated with our returns), and Free Audit Defense - click here to read the program terms. When I initially started using Credit Karma, I was able to import my previous tax return so that most of my information could be populated into the new tax return - so it’s easy to switch from another program to this one. In the past, I’ve also had to amend a tax return and re-submit, I was able to facilitate that through Credit Karma (but for amendments, you do have to end up mailing in the amended return). If a change can be made online, Credit Karma will notify you and let you resubmit electronically. You also have the ability to file for an extension through the site.

CONCLUSION

Visit the Credit Karma Tax page for answers to FAQs, getting a refund estimate or starting on filing. The streamlined process was KEY for me since I have to spend an immense amount of additional time going through every single one of my expenses and categorizing and recording them on top of filling out the online forms on Credit Karma. The colorful but simple interface makes the process much more pleasant, since it usually is a stressful and anxiety filled time. This year especially, I was filing with a “Married Jointly” status, and that didn’t in any way affect the ease of being able to prepare and file my returns, and that was a relief for Scott and I. This post is not in any way sponsored or endorsed by Credit Karma - after years of using it for tax prep, I felt that with my positive and hassle free experiences with it, I had to share it!