Credit Karma Tax now Cash App - Filing 2021 Tax Returns

*This content in this blog post has been shared for informational purposes only, and is not intended to provide, and should not be depended upon for tax, legal or accounting advice. You should consult your own tax , legal and accounting advisors before engaging in any transactions.

With the start of a new year, I have made it a habit to start finalizing my expenses and double check all my freelance work, as well as compile W-2s and 1099 forms as they are made available to me. This is because I’ve spent many a sleepless (well not sleepless but it felt like it), going through paper receipts and notes when I’ve procrastinated in the past. So I’ve just pushed myself in the last couple of years to be more proactive with tax preparation especially since my filing status changed by having to file with my husband. Since 2017 I’ve filed my taxes using Credit Karma’s free tax service (actually 100% free, no fees to file - this was important since I had to report freelance work) - I couldn’t recommend it enough. This year, I got an extra early start the first week of the new year and logged into my Credit Karma tax filing portal to find the news that they had been acquired by Cash App, and now Cash App was the filing service - still free, but there was a learning curve with accessing my account and figuring the best way to file (with married jointly or separately).

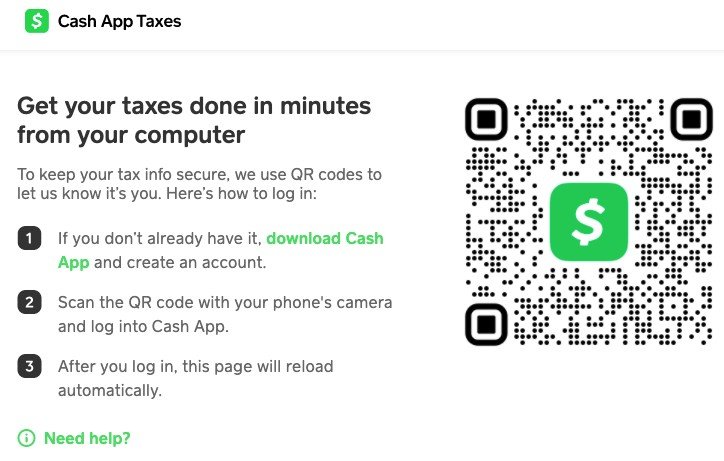

Overall, Cash App Taxes is easy to navigate and use - I didn’t have any issues finding where and how to input information, upload any documents if needed and do a check for errors before e-filing. From what I recall, it is very similar if not an almost identical experience to Credit Karma Taxes. The only snag I encountered was trying to access the platform itself because it’s tied to the actual Cash App mobile app, and the platform does not have the capability to file (married) separately for state taxes (California). I was trying to access the platform fairly early (first week of January 2022) so I think the instructions were not as clear/lacking, but now it’s very straightforward on downloading the app, creating an account and accessing the tax dashboard on mobile or desktop. In the end we filed married jointly so that we could also e-file our state taxes - that was a significant downside for me if I wanted to file differently.

To conclude my thoughts on using Cash App Taxes, I have included my pros and cons. In the past I’ve filed with a tax professional, as well as used turbotax and taxact, but Credit Karma Taxes was truly the only platform where I did not have to pay any fees to file for federal AND state, and gave me the ability to report all of my freelance work with ease. This particularly came in handy when I started new businesses last year, and also included needing to file for my ecommerce storefront.

CONS

*Although I could access all of my Credit Karma tax returns through 2017 - the support page said it would be available January 2022 but it took awhile for my returns to populate. (I received access early Feb 2022). I always save my returns after filing anyways, but since it was listed as a capability it was disappointing to not be able to access immediately (especially if you had the functionality to be able to file)

Cash App Taxes did not support submitting married filed separately for state (California).

During the error check before submitting, I received an error but it was unclear as to how exactly I could fix it. After mulling it over I figured it out.

I liked that the informational tabs for each section linked to the IRS page because it doesn’t get more official than that, but it would be more time efficient to include layman’s terms and clarifications provided by Cash App Taxes so I don’t have to review 10 pages of IRS documents unless I really need to do a double check.

PROS

Intuitive platform on desktop & mobile (I briefly looked at mobile and it seemed identical)

Still absolutely free to file federal and state - no matter the tax situation, and no hidden fees

Accurate calculations given the complexity of mine and my husband’s forms and deductions

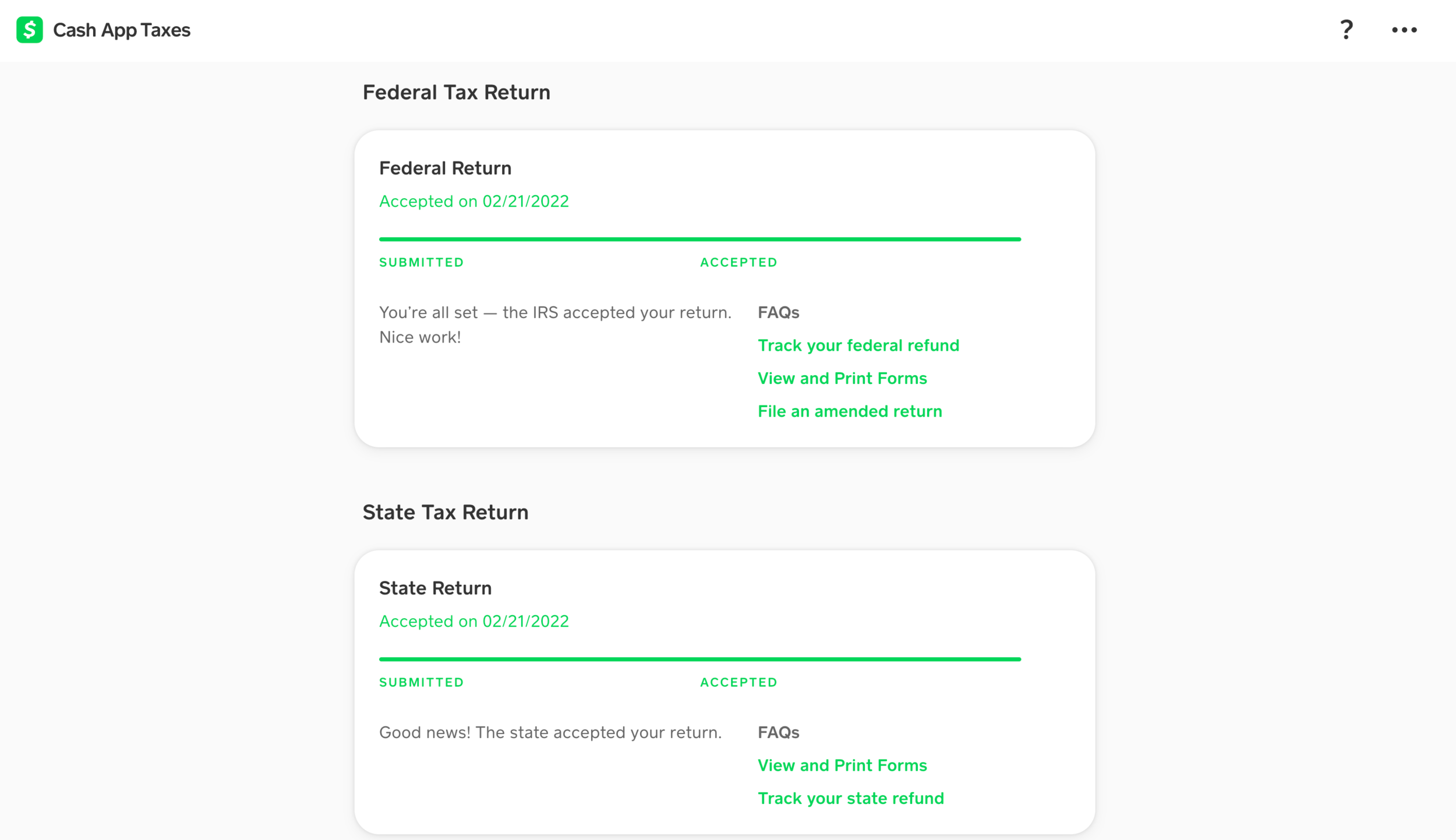

Appropriate amount of updates via email, and the statuses shown on my personal dashboard were easy to follow so I knew when the IRS accepted the return and when my refund was being sent. Subsequently, there are direct links to the IRS and state pages to track refunds.

Free audit defense is included

Quick federal/state acceptances and refund turnaround (this may be because I filed early - submitted federal & state on Feb 21st as soon as my state opened up for receiving returns)

Can access previous Credit Karma Tax return filings*